Maker/Taker Fee For BitNasdaq Margin Trade

Crypto Expert BNB

Updated at: 6 months ago

The Maker/Taker fee structure is a key element of BitNasdaq's Margin Trading platform, providing users with a transparent and competitive fee system. Understanding how this fee works and how it varies according to VIP levels can help traders optimize their trading strategies and reduce costs effectively.

What is the Maker/Taker Fee?

In the context of Margin Trading on BitNasdaq, the Maker/Taker fee refers to the trading fee charged when a user either creates liquidity in the market, Maker, or takes liquidity from the market, Taker. These fees are designed to encourage market participation, with the structure rewarding those who contribute to the platform's liquidity.

Maker: A maker is a trader who places an order that doesn’t immediately match with an existing order on the order book, thereby adding liquidity to the market. Makers are typically rewarded with lower fees since their actions help build the market.

Taker: A taker is a trader who places an order that immediately matches with an existing order on the order book, thereby removing liquidity from the market. Takers generally pay higher fees because their trades consume liquidity.

VIP Levels and Fee Structure

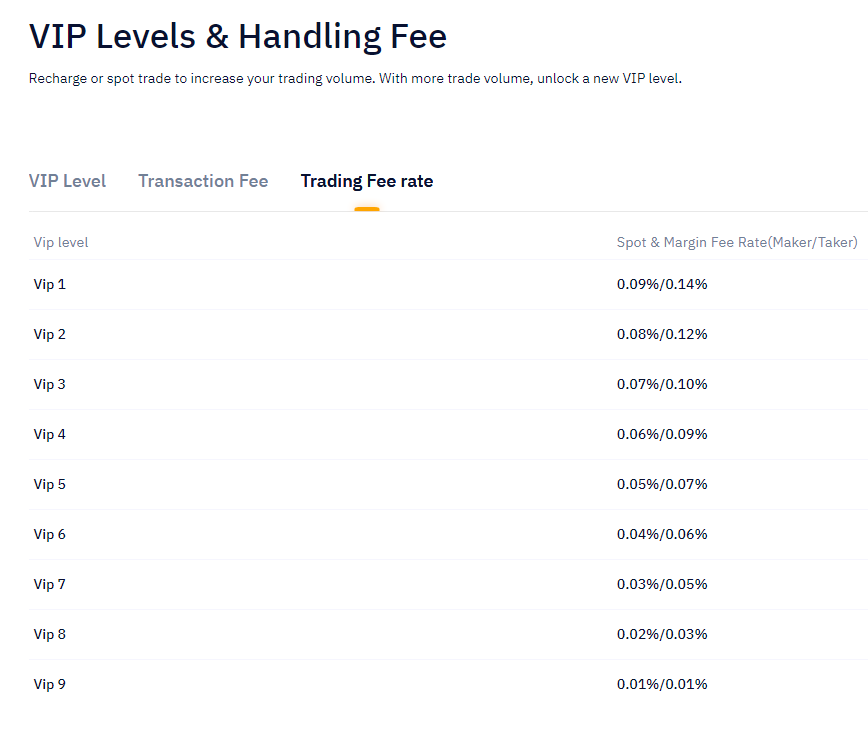

BitNasdaq offers a tiered VIP level system, where traders can achieve different levels based on their trading activity and volume. As traders move up the VIP ladder, they benefit from reduced Maker/Taker fees, incentivizing higher trading volumes and more consistent market participation. The VIP levels and corresponding Maker/Taker fees for Margin Trading are as follows:

VIP Level: 1 Maker/Taker Fee: 0.09%/0.14%

VIP Level: 2 Maker/Taker Fee: 0.08%/0.12%

VIP Level: 3 Maker/Taker Fee: 0.07%/0.10%

VIP Level: 4 Maker/Taker Fee: 0.06%/0.09%

VIP Level: 5 Maker/Taker Fee: 0.05%/0.07%

VIP Level: 6 Maker/Taker Fee: 0.04%/0.06%

VIP Level: 7 Maker/Taker Fee: 0.03%/0.05%

VIP Level: 8 Maker/Taker Fee: 0.02%/0.03%

VIP Level: 9 Maker/Taker Fee: 0.01%/0.01%

VIP Level 9 represents the highest tier with the lowest fees, making it the most desirable level for frequent traders looking to minimize costs. This tiered fee structure rewards active participants and high-volume traders, making Margin Trading on BitNasdaq more profitable as traders ascend the VIP levels.

Benefits Of The Maker/Taker Fee Structure

Cost Efficiency: As traders advance to higher VIP levels, the cost of trading decreases significantly, allowing them to retain more of their profits.

Liquidity Incentives: The lower Maker fees encourage traders to add liquidity to the market, which can lead to a more robust and active trading environment.

Encourages Market Participation: By offering lower fees to higher-tier VIP members, BitNasdaq incentivizes continued engagement and trading on the platform, fostering a dynamic trading ecosystem.

BitNasdaq's Maker/Taker fee structure is a well-thought-out system that aligns with the interests of traders by offering lower fees as they progress through the VIP levels. Whether you're a beginner or a seasoned trader, understanding and leveraging this fee structure can enhance your trading strategy, reduce costs, and ultimately improve your profitability in Margin Trading. As you trade more and reach higher VIP levels, the benefits of reduced fees become increasingly significant, making BitNasdaq a competitive platform for Margin Trading in the cryptocurrency market.